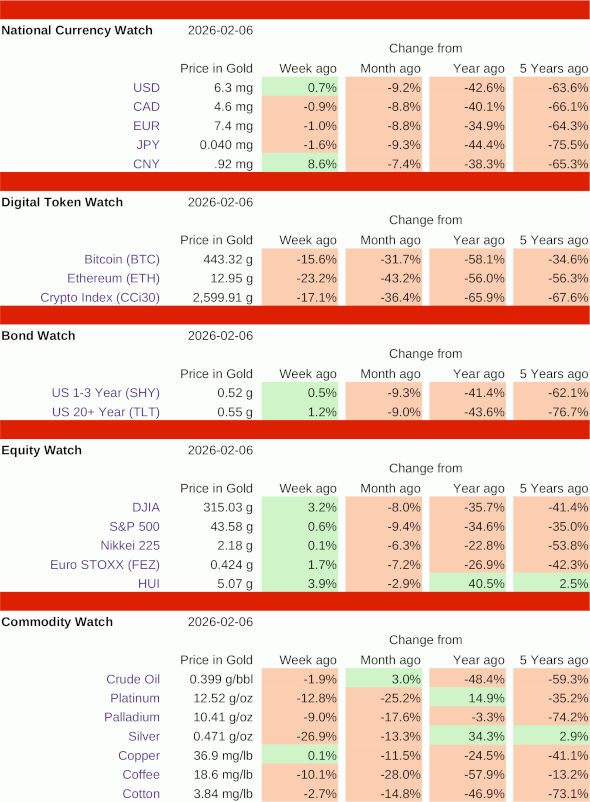

Stocks and bonds rose, cryptos declined, and national currencies and commodities finished mixed. The largest gains were in the Chinese Yuan, up 8.6%, gold stocks, up 3.9%, and the Dow Industrials, up 3.2%. The largest losses were in Ethereum, down 23.2%, silver, down 26.9%, and the CCi30 index, down 17.1%.

The US Dollar rose 0.7%, while short term treasuries gained 0.5% and long term bonds closed up 1.2%. This week, the Dow and the S&P 500 both hit new all-time highs when priced in US Dollars, but are down about 75% from their all-time highs against gold.

Click for PDF version