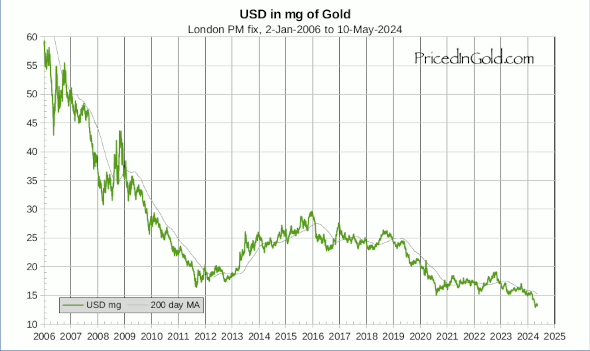

The USD, at 19.4 mg, is down 2% for the year to date, but is 4.5% above it's 200 day moving average and 18% above its all time low of 16.4 mg, set in September of 2011. It has been in an uptrend since then, crossing above the moving average line on 3/14, and testing it as support on 3/27.

Looking at the bigger picture, the USD continues to follow it's half-life curve closely. As I have described before, the Fed seems to have settled on a policy of gradual debasement – as much as they can get away with, but not so much as to create a panic. The chosen rate of decay cuts the value of the dollar roughly in half every four years, and has been doing so since 2001. This seems to be working very well so far. Until the authorities lose control of their monetary monster or decide that rate of debasement needs adjustment, I suspect this policy will continue.

The chart above shows that there is plenty of room in this policy for extended runs of above and below par performance; in 2005 the USD was 20% above it's predicted value, in 2008 it was as much as 21% below. 2011 saw the dollar undervalued by 24%. Currently, it is 2.1% above track, right on the line for all practical purposes.

And for the future? The half-life curve suggests a USD price of 17.2 mg for the end of 2012, equivalent to a gold price of $1,805 per ounce, and 14.5 mg (implying a gold price of $2,140/oz) at the end of 2013, but there are many fundamentals that determine the value placed on the dollar at any particular point in time.

I suspect that the big driver for the next year will be the Euro-wreck now gaining momentum. If Spain, Portugal, Ireland and perhaps even Italy follow the Greek's footsteps, the monetary floodgates at the ECB (and thus indirectly, at the Fed) will open wider than ever before, and fiat currency weakness will be the order of the day. But the USD, the world's reserve currency, seen by many as the "least ugly contestant in the beauty pageant" may benefit as much as, or even more than, gold, leading to a rise in it's value relative to gold. Rest assured that any such rise will eventually be made up for to the downside; the untold trillions of USD debts outstanding will not be paid off at today's value in gold terms. Lots more debasement is required to cleanse the system of those debts, unless outright default occurs – and in that case, cash dollars will become scare and precious, but so will gold, as the entire financial system will be in crisis.

And when the fire-storm is over, and the dust settles, the paper promises will have vanished, but the gold will remain. Be sure you have as much of it as possible.

Leave a Comment