Market Update 26 Apr 2013: Coffee tumbles

This week saw a pullback after the prior week's monster rally. Government-issued currencies, stocks and bonds all gave up about half of last week's gains, while Bitcoin continued its recovery. Commodities were mixed, with silver continuing to fall, crude oil continuing to rise. The week's biggest loser was coffee, which gave back much of its gain from last week.

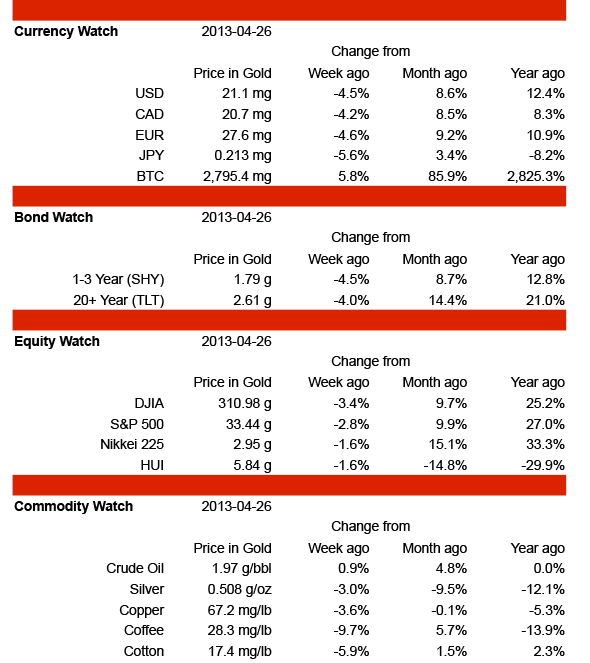

Bitcoin trading was calmer this week, with lower volumes (a daily average of 380 kg vs 535 kg last week). Prices rose in the first part of the week, peaking at 3.3 g on Wednesday, then declined to close the week at 2.8 g, 5.8% higher than last week's close. Among the government currencies, the JPY was weakest, falling 5.6%, while the Canadian dollar was the "strongest", falling only 4.2%. The USD was down 4.5% to 21.1 mg; this is still 29.5% above its half-life curve, and represents an excellent selling opportunity for those holding USD assets.

Bonds were lower, with short term SHY down 4.5% while the long term TLT lost 4.0% to close at 2.6 g. This leaves TLT just above its support level at 2.55 g.

Stocks were all lower, lead by the Dow Jones Industrials which fell 3.4% to close at 311 g. The Nikkei Index and the HUI Gold Bugs Index each lost 1.6%. Although the HUI closed lower this week than last week, at 5.84g it is still holding above the low of 5.75 g set on April 17th. It is possible we'll see a rally from here to retest resistance at 6.5 to 6.7 g.

Commodities were lower, with the exception of crude oil, which gained 0.9% to 1.97 g/bbl. Coffee was the week's biggest loser, falling 9.7% to close at 28.3 mg/lb. Silver also continued it's fall, losing 3% to close at 0.508 g after spending Wednesday and Thursday at 0.499 g. Platinum dropped 0.9% to close the week 0.8% above parity with gold.

Filed under Bitcoin, Bonds, Coffee, Commodities, Cotton, Dow Jones Industrials, Platinum, Silver, Stocks, US Dollar by ![]()