Weekly Update 11 Aug 2017

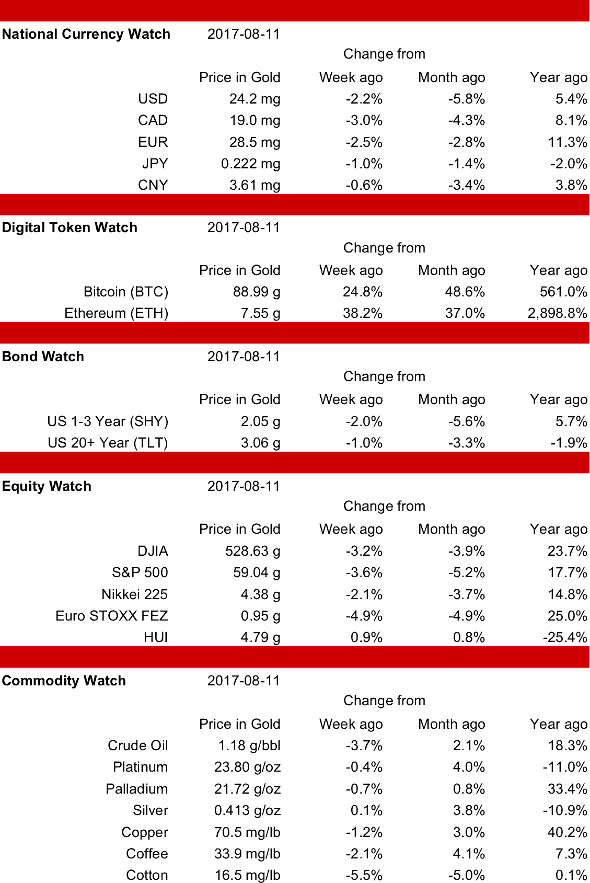

Most asset classes were lower, but digital tokens shot much higher. Ethereum rose 38.2% and Bitcoin gained 24.8%, continuing to rise after the successful Bitcoin hard fork on August 1st. Bonds, major stock indexes, and commodities were all lower.

The Chinese Yuan was the best performing national currency this week, falling 0.6%. The Canadian Dollar fell the most, dropping 3.0%. Bonds continued to favor the longer maturities, as the 20+ year TLT fell 1.0%, while the 1-3 year SHY lost 2.0% and USD cash (notes of zero maturity) dropped 2.2%.

Bitcoin rose all through the week, closing on Friday at 89 grams, a new all-time-high, and has continued to rise strongly since, trading at another new all-time high of 106.3 grams on August 14th. Ethereum followed a similar pattern, ending the week at 7.6 grams, a new high for the month, but still well below it's all-time high of 9.8 grams set on June 12th.

Gold stocks gained 0.9% this week, but all the major market indexes were lower. The Euro STOXX was the weakest index, falling 4.9%. The DJIA was off 3.2% while the S&P 500 fell 3.6%.

Commodities were all lower except for silver, which was virtually unchanged (up 0.1%). Cotton and crude oil fell the most, dropping 5.5% and 3.7% respectively.

Click for PDF version

Filed under Bitcoin, Bonds, Commodities, Cotton, Dow Jones Industrials, S&P 500, Silver, Stocks, US Dollar by ![]()