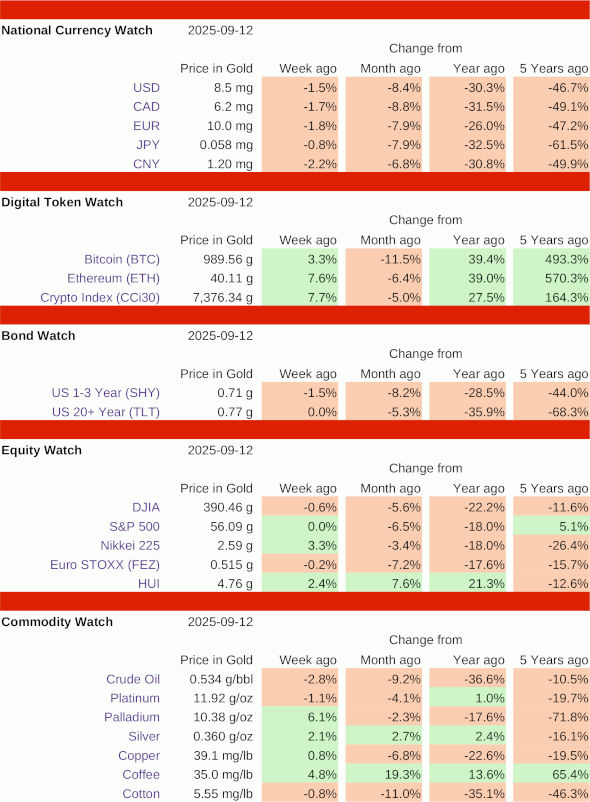

National currencies and bonds moved decisively lower, while other asset classes were mixed. The week's best performers were platinum, up 4.7%, gold stocks, up 3.5%, and the CCi30 "altcoin" index, up 2.6%. The largest losses were in coffee, down 8.6%, US stocks (S&P 500 down 7.3% and Dow Industrials down 7.1%), and long term bonds, down 6.7%. The US Dollar fell 4.8%, and Bitcoin closed off 1.4%.

The Chinese Yuan, down 3.1%, was the strongest national currency, followed by the Japanese Yen, which lost 3.4%. The US Dollar was the weakest national currency, dropping 4.8%. It was only slightly outperformed by short term notes, which fell 4.7%, but massively outperformed long term bonds, which crashed 6.7%.

Equity indexes, with the exception of gold stocks, were all lower, led by the S&P 500, down 7.3%, and the Dow Jones Industrials, down 7.1%. Outside of gold stocks, which rose 3.5%, the Euro STOXX50 index was the strongest, falling "only" 4.8%.

Commodities saw the most violent price action, both positive and negative. Platinum rose 4.7%, and copper advanced 0.5%, while coffee fell 8.6% and crude oil dropped 6.2%. Silver closed the week off 1.9%.

Bitcoin fell 1.4%, outperforming all national currencies, bonds, and major stock indexes. It spent most of the week above 1 kg, and made a new all-time high in USD terms on Thursday before pulling back on Friday to close at 998 grams. Priced in gold, it sits about 20% below its all-time high of 1,251 grams. The privacy coin Monero (symbol XMR, not in table) had a fantastic week, rising 11.7%, more than any other asset I track.

Click for PDF version